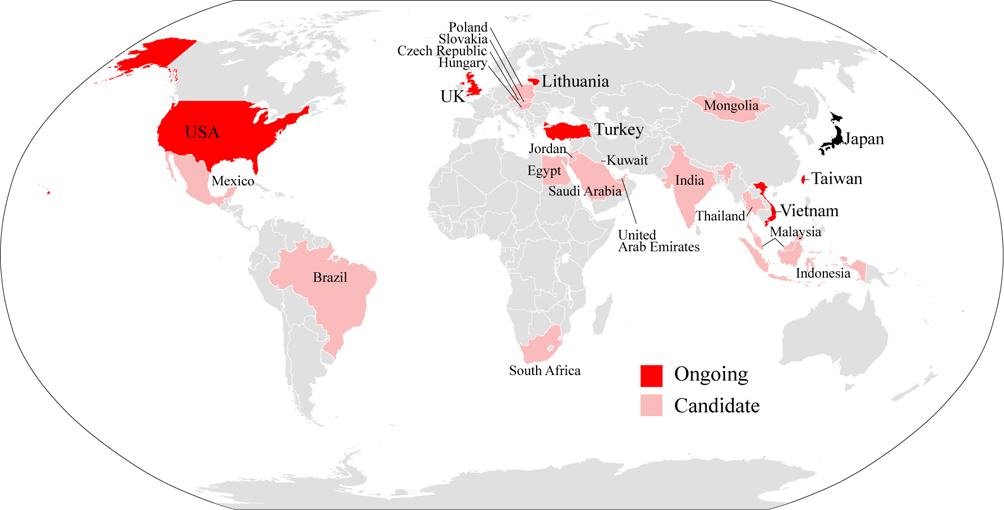

1. Ongoing cases There are now two ongoing plans for the construction of NPPs in Turkey. One is the NPP construction plan in Akkuyu, on the Mediterranean coast, where four Russian Rosatom VVER-1200 reactors (1,200 MW-class Russian PWRs, the first of which is due to come online in 2020) are scheduled to be built. The other is an NPP construction plan for Sinop on the Black Sea coast ordered from an international consortium led by Japanese companies (consisting of Mitsubishi Heavy Industries, Itochu Corporation, GDF Suez, Turkish Electricity Generation Company Incorporated (EUAS), and others). Four ATMEA-1 reactors (1,100 MW-class PWRs, the first of which is due to come online in 2023) are to be built under the plan (related news). However, both plans have met with fierce opposition from local residents (see “Sinop Says No to Nuclear”). Similarly, there are also two ongoing plans to build NPPs in Vietnam. One is for Russia’s Rosatom to construct two VVER-1000 reactors (1,000 MW-class Russian PWRs, the first of which is due to come online in 2020), and the other ordered from the International Nuclear Energy Development of Japan* (JINED) to build two 1,000 MW-class reactors (the first of which is due to come online in 2021 despite the reactor type not having been selected yet). Both NPPs are to be constructed in Ninh Thuan Province in central southern Vietnam. It is, however, expected that the construction plans will be delayed since Vietnam’s domestic regulations require strengthening. [*Note: The shareholders of the International Nuclear Energy Development of Japan (JINED) include the major Japanese electric power companies, Toshiba, Mitsubishi and Hitachi.] Lithuania has a plan for the construction of an NPP, which has been ordered from Hitachi-GE Nuclear Energy. Under this plan, one Advanced BWR (1,350 MW-class ABWR, due to come online in 2020) is to be built on the banks of Lake Druksiai in eastern Lithuania. Nevertheless, although not legally binding, 62% of voters opposed the construction plan in a referendum held in 2012, and since there has also been a change in government in the meantime, the future of the construction plan has become uncertain. In the UK, Hitachi has purchased the NPP construction company Horizon and has two ongoing plans to construct two or three ABWRs (1,300 MW-class) at each of two sites, at Wylfa on Anglesey (Wales) and at Oldbury-on-Severn in South Gloucestershire. Toshiba has also bought 60% of the shares in the NPP construction company NuGeneration and plans to build three AP1000 reactors (1,000 MW-class PWRs, to be constructed by Toshiba’s Westinghouse, the first of which is due to come online in 2024) at Moorside in West Cumbria. Two nuclear reactor construction plans in the USA have gained COLs (combined construction and operating licenses) from the Nuclear Regulatory Commission (NRC). One is for Units 3 and 4 at the Vogtle NPP in Georgia, and the other is for Units 2 and 3 at the V.C. Summer NPP in South Carolina. Both constructions have been ordered from Westinghouse, and are due to introduce AP1000s. In Tennessee, the construction of Watts Bar Unit 2, a Westinghouse 1,210 MW PWR suspended since 1988, has also resumed, and the reactor is now under construction. Further, Taiwan’s fourth NPP, Lungmen, now under construction in New Taipei City, was ordered from GE, but in fact Unit 1 reactor was produced and delivered by Hitachi, Unit 2 by Toshiba, both 1,350 MW ABWRs, and the generators will be provided by Mitsubishi Heavy Industries. However, due to a large-scale citizens’ protest movement, there is little expectation for the reactors to actually come online.

2. Other Candidate Countries The Japanese government is currently giving active support for the export of NPPs and is rushing to conclude bilateral nuclear power cooperation agreements, the prerequisite for NPP exports. Noting only those which have been publically announced thus far, Japan is now engaged in ongoing agreement negotiations with India, South Africa, Brazil, Mexico, Malaysia, Mongolia, Thailand, and Saudi Arabia. Moreover, as Jordan and Kuwait have already concluded agreements, and agreements with Turkey and the United Arab Emirates are awaiting approval by the Diet, these countries can also be recognized as candidates for NPP exports. Japan has also concluded a nuclear power cooperation agreement with EURATOM (the European Atomic Energy Community), and is conducting strong sales activities with the EURATOM member states of Poland, the Czech Republic, Slovakia and Hungary. PM Abe acted as a top salesman for NPPs in talks with the heads of state of these countries in June 2013. Despite the fact that Japan has not yet concluded nuclear power cooperation agreements with Indonesia and Egypt, these two countries are also currently being targeted by the Japanese nuclear industry for possible NPP exports. However, in Thailand, for example, while a plan for the construction of a two-reactor NPP has been incorporated into the Thailand Power Development Plan 2012-2030, the citizens harbor strong anti-nuclear sentiments and a local activist has commented to the author in an interview that “This project has been included in the plan simply for the purpose of obtaining budget.” Furthermore, the NPP construction plan which was scheduled to move forward in Kuwait with the support of Japan was suspended after the Fukushima Daiichi Nuclear Power Station accident. 3. A case in which an order failed to materialize In 2013, Toshiba acquired the preferential negotiating rights for an NPP to be constructed at Hanhiviki in Finland. The Finnish NPP company Fennovoima later altered the construction plan from the large-scale reactor in the original concept to a medium-sized reactor, and as a result Rosatom is now scheduled to build the NPP. (Hajime Matsukubo, CNIC) Return to Energy Policy / Nuclear Trends / Nuclear Industry page Return to NIT 159 contents |

| CNIC Citizens' Nuclear Information Center Akebonobashi Co-op 2F-B, 8-5 Sumiyoshi-cho, Shinjuku-ku, Tokyo, 162-0065, Japan TEL.03-3357-3800 FAX.03-3357-3801 Map http://cnic.jp/english/ |